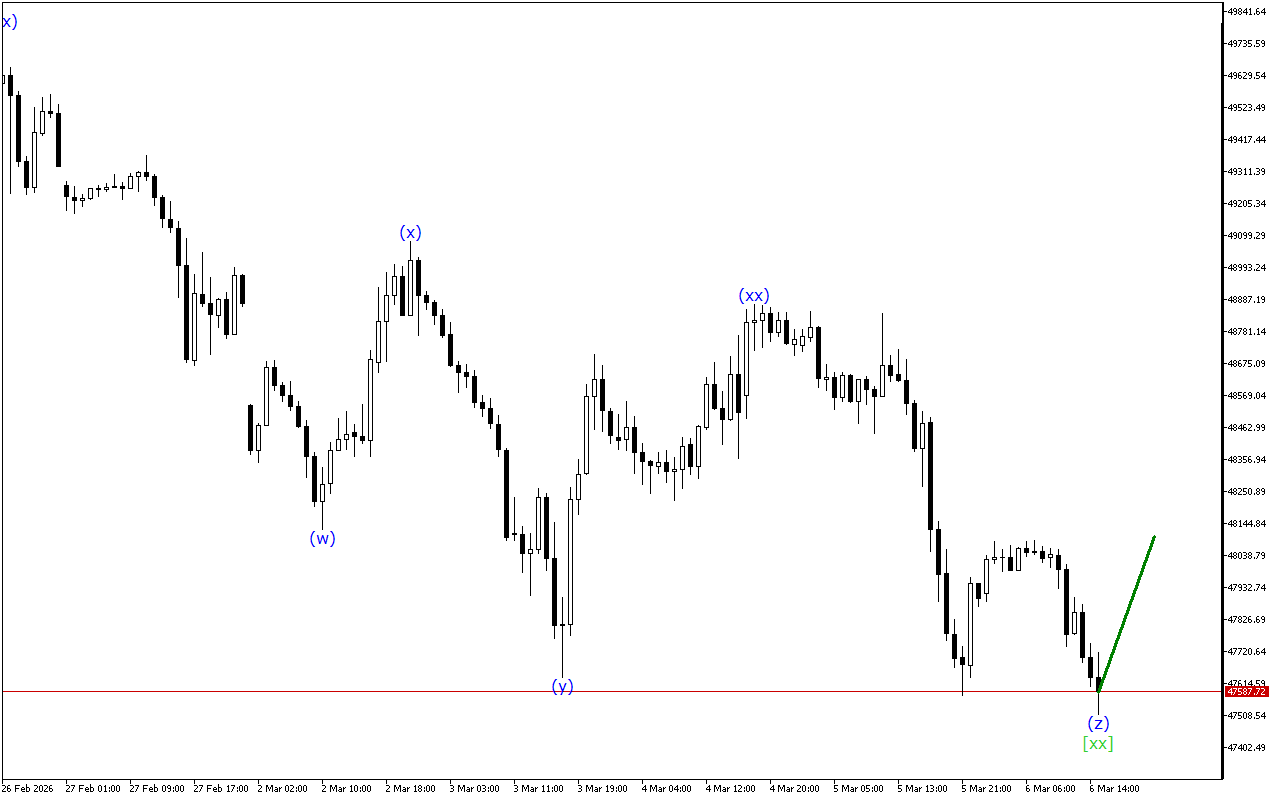

The market remains in a downtrend, though wave analysis indicates a potential end to the current trend.

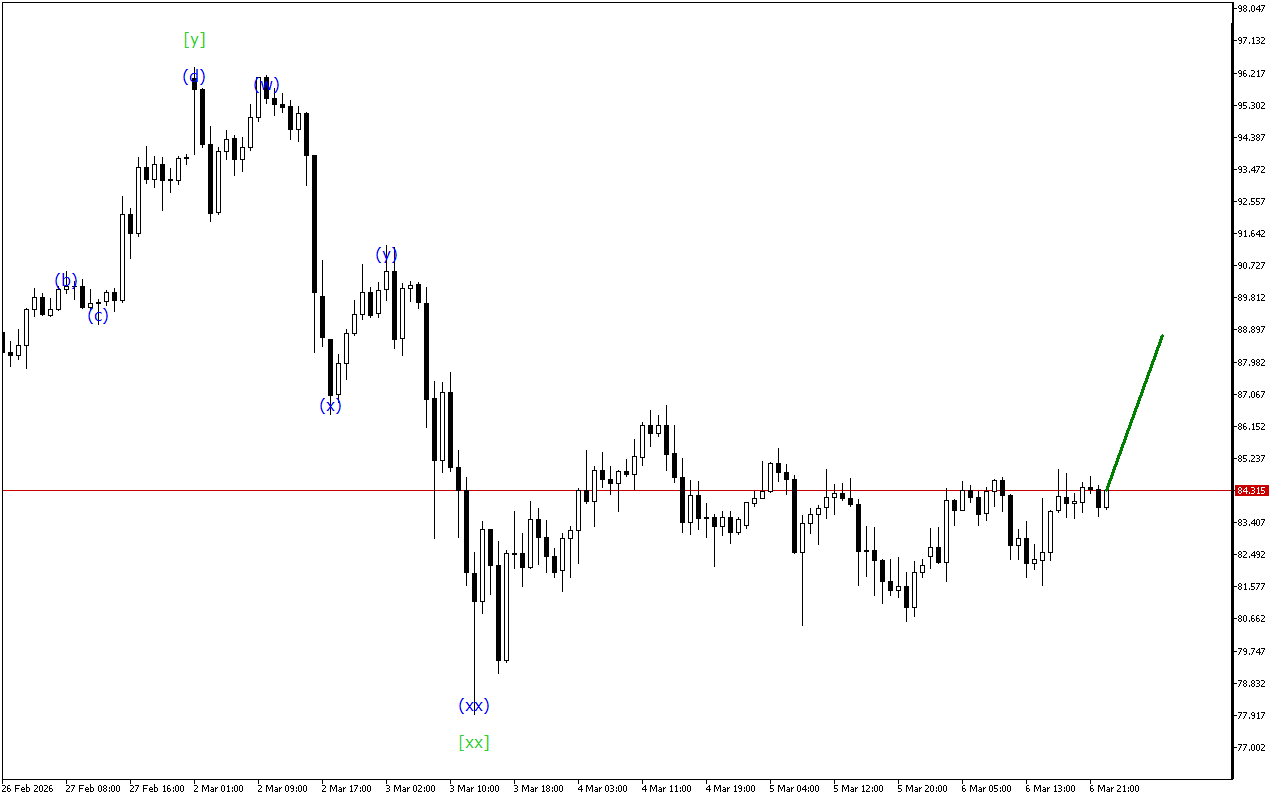

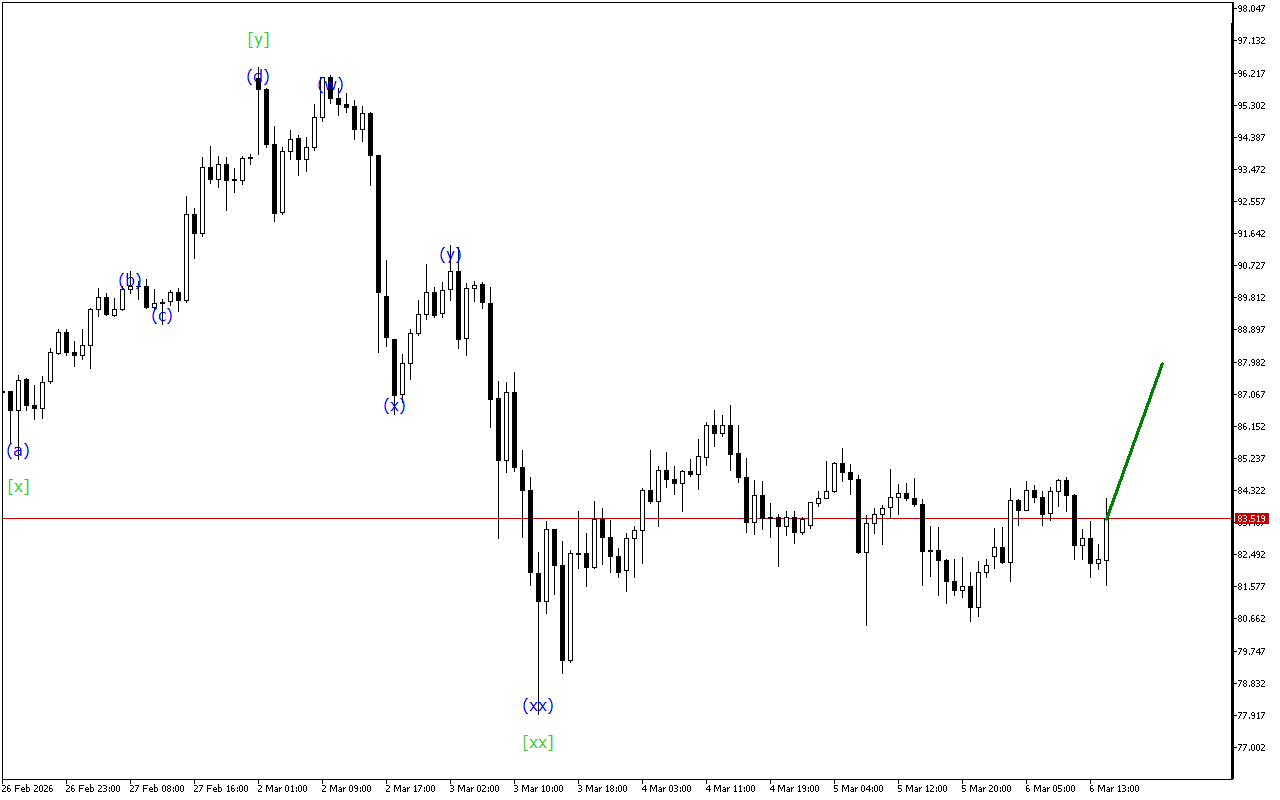

The medium-term movement vector of USDJPY indicates the formation of a Triple Three wave structure. Now the formation of the wave [xx] is completed and the beginning of an upward movement within the wave [z] is expected.

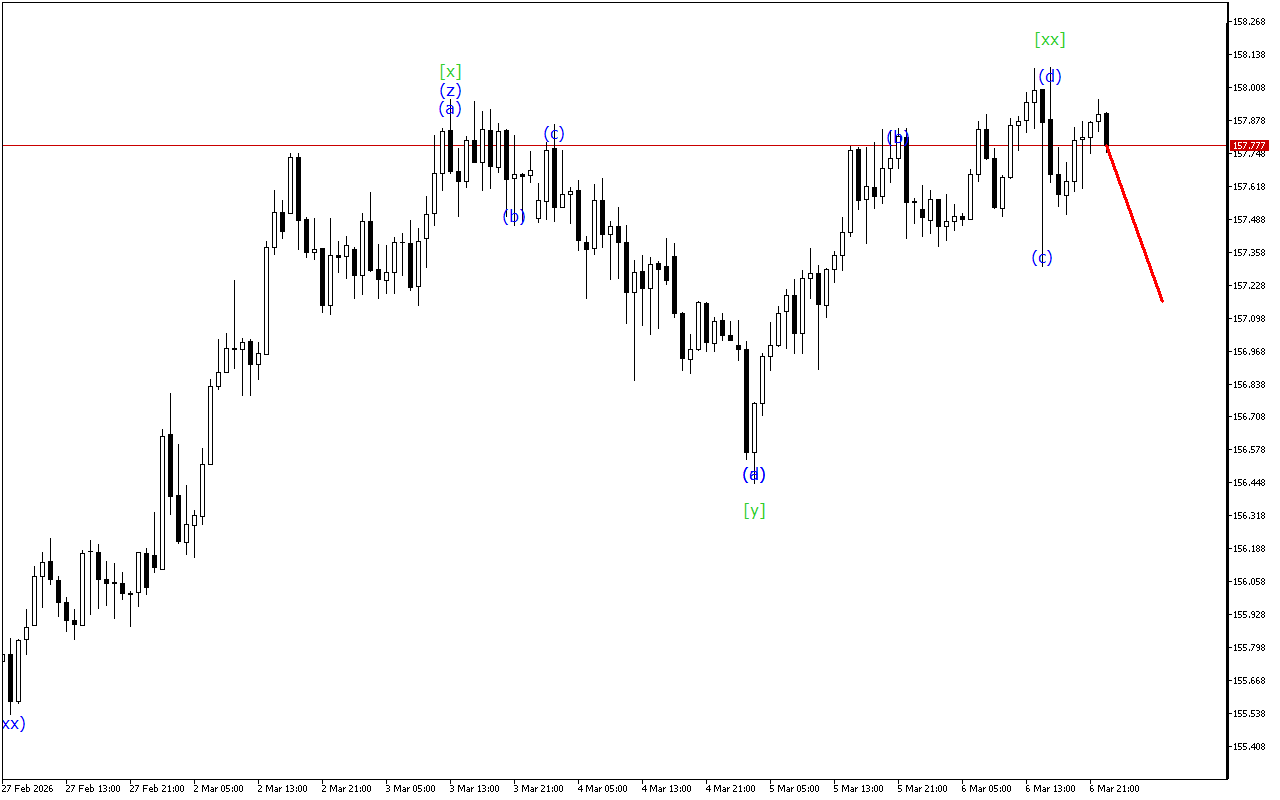

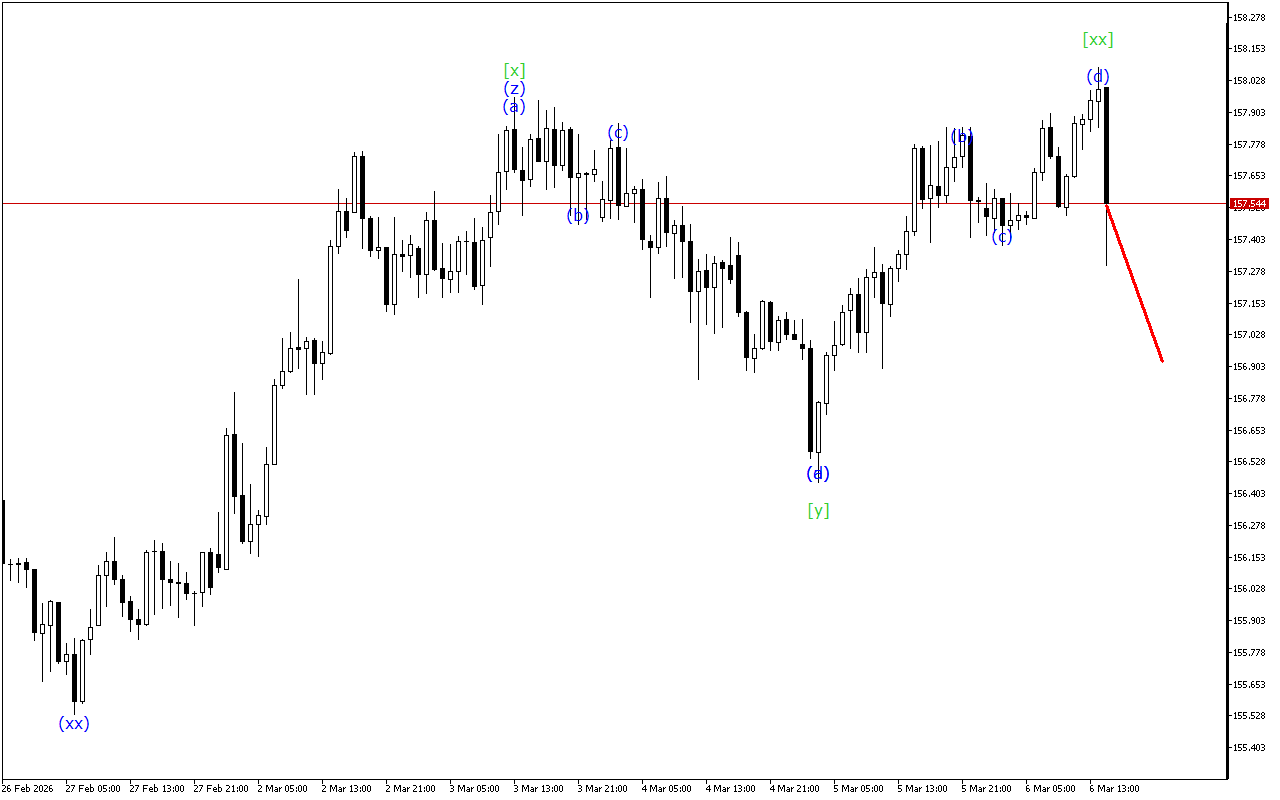

According to a smaller time-frame, the market moves within the ABC zigzag. Currently, the price is completing the formation of the wave (c) apparently and the price movement may move into a new wave formation.

To summarize, at the moment the USDJPY chart is maintaining a downward movement vector. However, the corrective wave is in the final stage of formation.

In this situation, long positions are prioritized.

Alternative scenario

Short positions will be relevant after the breakout of the current wave start level

USDJPY H1: Wave Analysis for the American Session on 10.2.2026

Related Posts

XAGUSD H1: Wave Analysis for the Asian Session on 9.3.2026

Despite the decline, there are signals on the XAGUSD chart indicating a possible upcoming change in direction.XAGUSD continues to move within the Triple Three wave structure. Now, apparently, the formation…

USDJPY H1: Wave Analysis for the Asian Session on 9.3.2026

The USDJPY chart shows signals for the end of the upward movement phase.The current dynamics of the movement indicate the formation of a triple three. At the moment, the wave…