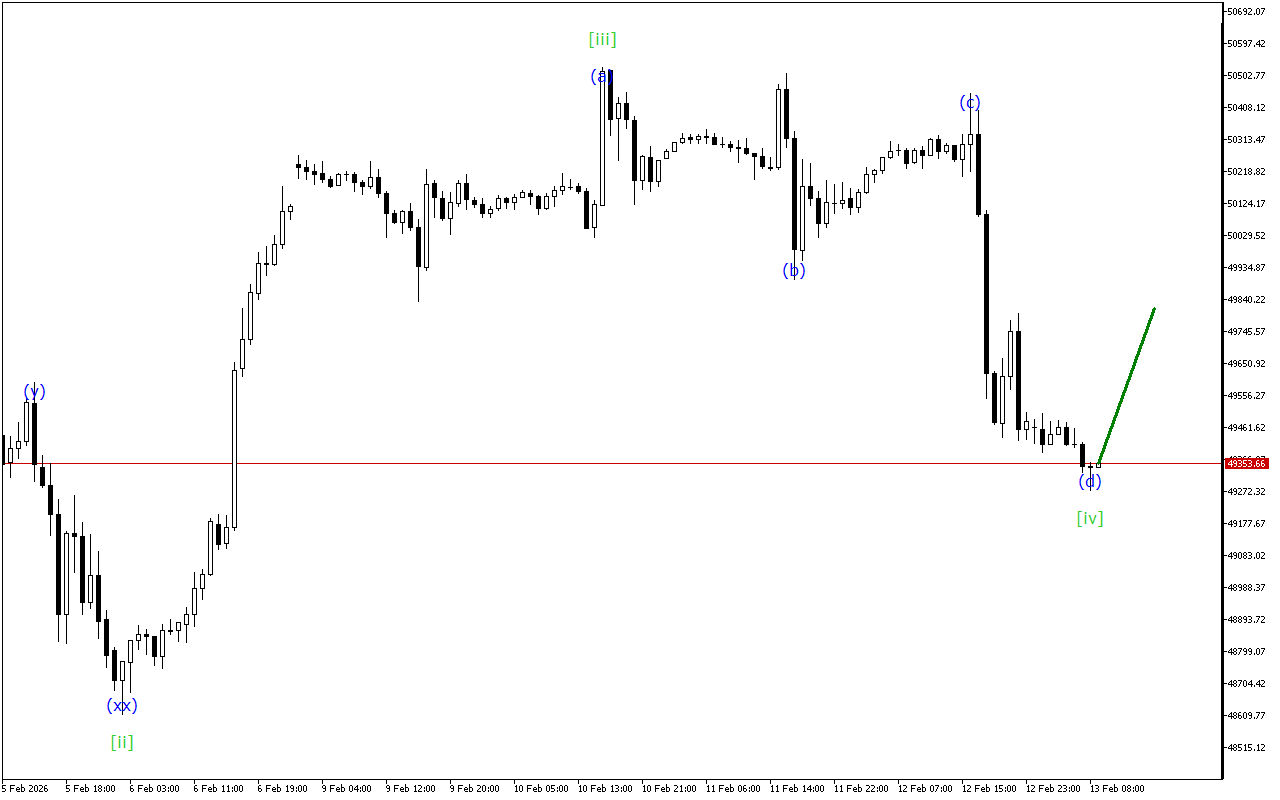

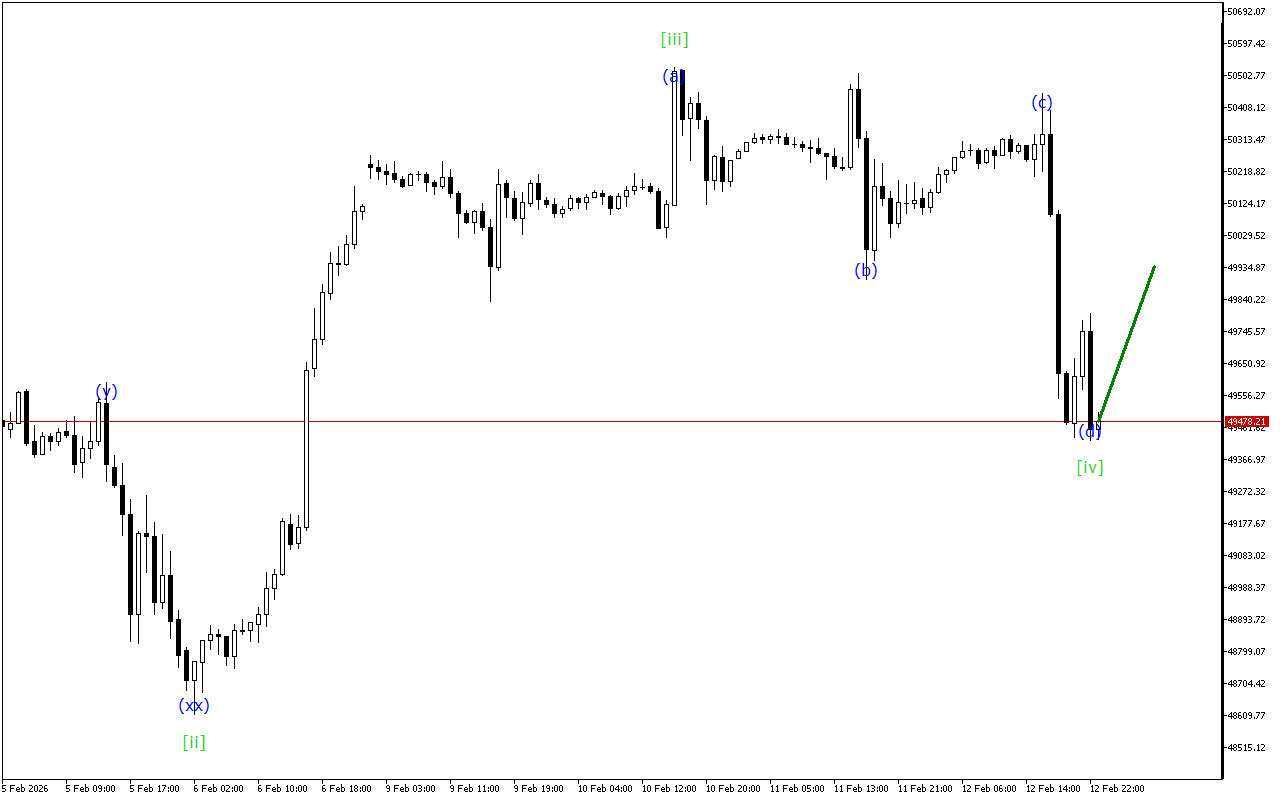

The Dow Jones chart shows signals for the end of the upward movement phase.

There is the development of a triple three wave structure on a higher time-frame. Currently, the wave [xx] has been formed. After this the price should resume its downward movement.

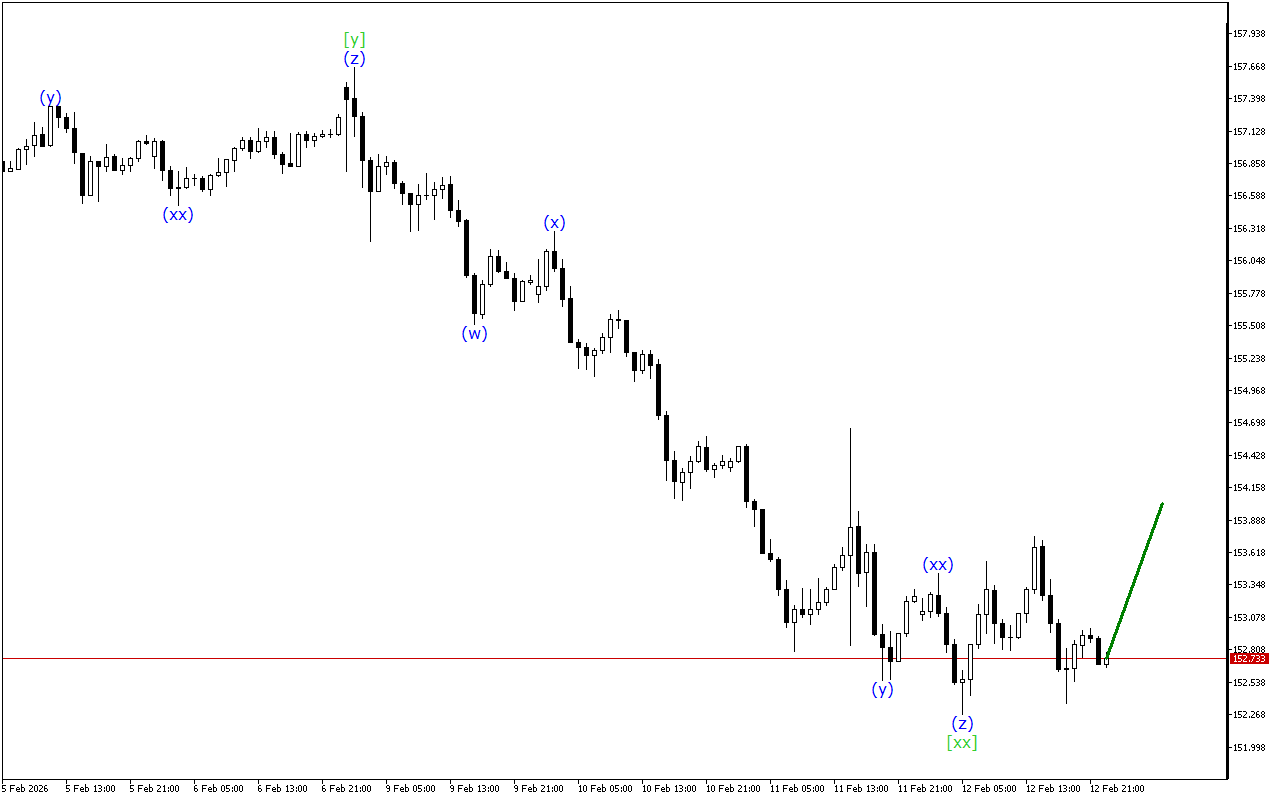

Waves of a lower time-frame form a triple three. The price is currently in the wave (z). When this wave is completed, a more directional price movement is expected.

Despite the positive dynamics of the market movement, the possibility of resuming the downward movement after the completion of the current wave shouldn’t be excluded.

In this situation, it should be emphasized that short positions remain preferable.

Alternative scenario

Long positions should be looked for after the breakout of the top of the current wave.

Dow Jones H1: Wave Analysis for the American Session on 5.2.2026

Related Posts

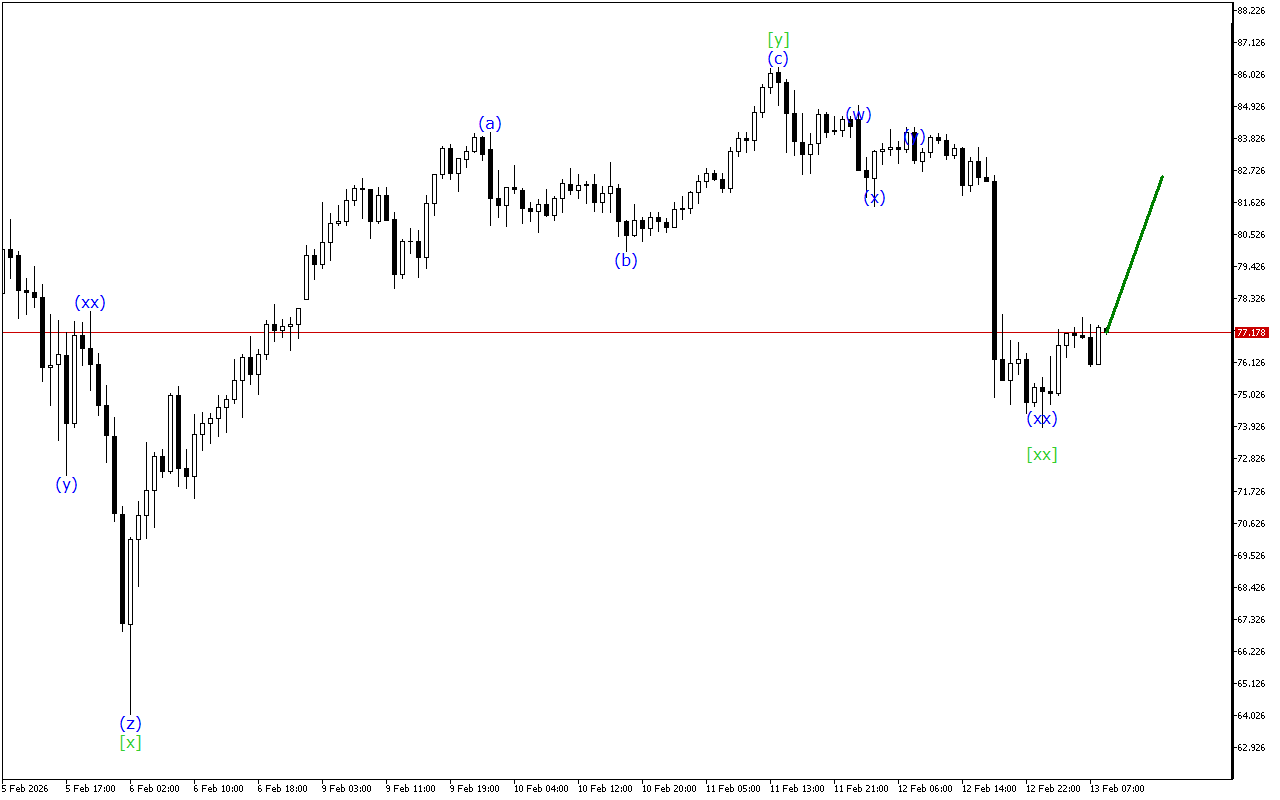

XAGUSD H1: Wave Analysis for the European Session on 13.2.2026

Despite the steady decline in price, the XAGUSD chart is giving signals about a possible completion of the current bearish momentum.The medium-term movement vector of XAGUSD indicates the formation of…

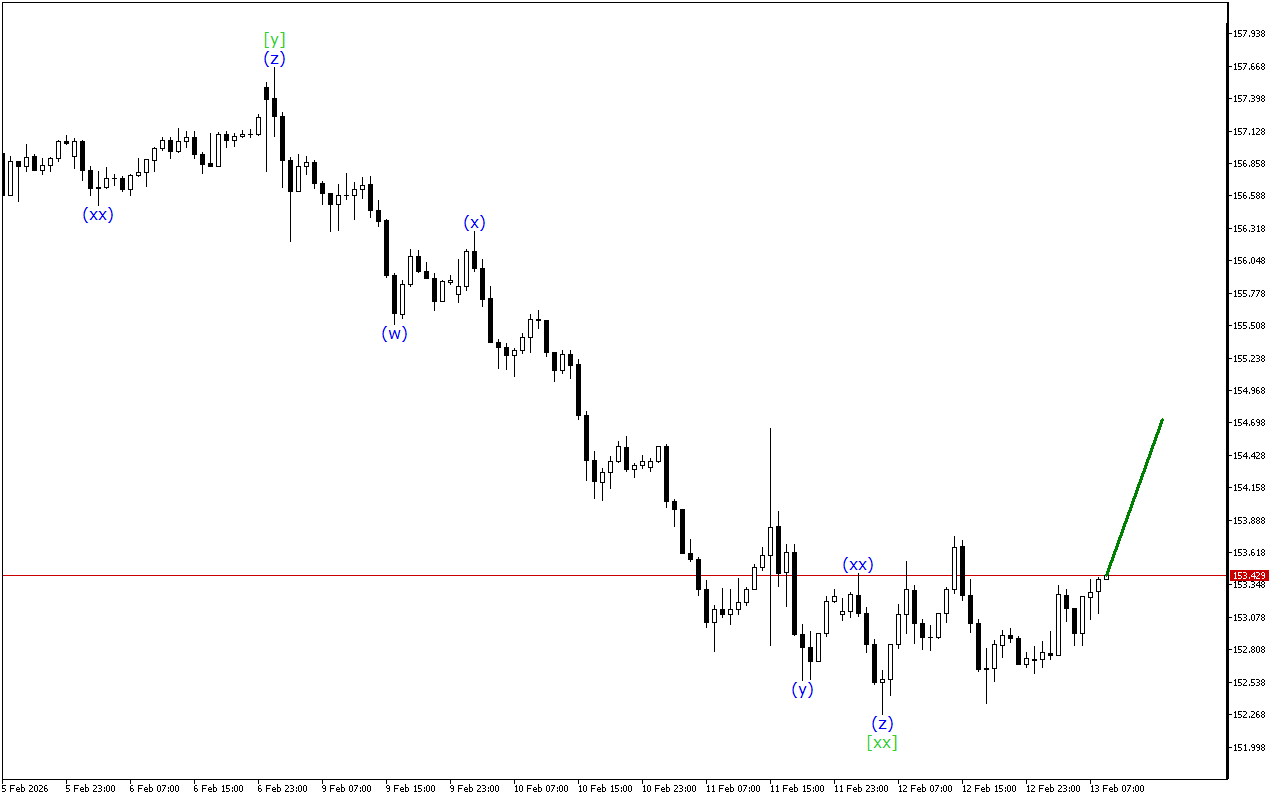

USDJPY H1: Wave Analysis for the European Session on 13.2.2026

The price continues to move down, but the USDJPY chart shows signs that the downward momentum is likely to end soon.USDJPY continues to move within the Triple Three wave structure.…